Trading is a game of probabilities. Thinking in terms of probabilities and not ‘right and wrong’ is perhaps the most important mindset shift.

This note includes the following topics:

- Thinking in Probabilities

- The Casino Paradigm

- The Expectancy

- Win Rate VS Profit-to-Loss Ratio

Thinking in Probabilities

- No one has the certainty to predict the future. It’s like asking what the next coin flip will be.

- None of the following entities can predict the future. AVOID seeking the next HOT stock tip.

- Nobel Prize-Winning Economist

- Financial Experts

- Newsletters

- CEO

- CNBC

Question: If nothing is predictable, how can we make money trading?

– Probability. With an EDGE (probabilistic advantage), you will always win in the long run.

The Casino Paradigm

- The Casino industry is built around the concept of probability.

- Take a Roulette game, where the outcome of the next spin is random. But the casino/house is still profitable.

- Why does the house win?

- The outcome of 10,000 spins is less random

- Betting on Red Or Black

- Probability of House Winning: 52.6% [EDGE]

- Probability of You Winning: 47.4%

- The outcome of 1 spin/trade is random. But if you have an EDGE, you will make money after many trades.

- No Edge, No Trading!!

The Expectancy

- Expectancy: How much money can I make per trade?

- Three key elements

- Win Rate a.k.a Batting Average: Number of profitable trades / Total number of trades

- Average Profit: Total profit / Number profitable trades

- Average Loss: Total loss / Number of unprofitable trades

- Use case

- If your expectancy is $100 and your total trades in a year is 150.

- You can estimate your yearly profit to be $15,000.

Expectancy = (Win Rate x Avg Profit) - (Loss Rate x Avg Loss)

Sample:

Win Rate: 40%

Avg Profit: $1,000

Avg Loss: -$500

Expectancy == (40% * $1,000) - (60% * $500) = $100

i.e. You can expect to make $100 per trade over the long run.

Will you make $100 in every trade?

- No. In fact, 60% of your trade will be a loss.

- But you will still make an average of $100 per trade if you stick long enough with your plan.

Win Rate VS Profit-to-Loss Ratio

- Win Rate a.k.a Batting Average: Number of profitable trades / Total number of trades

- Profit-to-Loss Ratio: Average Profit / Average Loss

- a.k.a Payoff Ratio or Avg Risk/Reward

## Best trading strategies have

- High Profit-to-Loss Ratio: >3

- Respectable Win Rate: >40% to 50%

HIGH Win Rate + LOW Profit-to-Loss Ratio

- Psychologically easy to trade since you win often. Hence attracts more people who can’t think in probabilities.

- But less robust since you do NOT have direct control over the market or win-rate when the market changes.

HIGH Profit-to-Loss Ratio + LOW Win Rate

- More forgiving. With a Profit-to-Loss ratio of 3, you can be wrong 7 out of 10 times and still make money.

- Difficult to trade when losing streak occurs. Must be able to think in terms of probability and NOT certainty

Profit-to-Loss Ratio = Average Profit / Average Loss

Sample:

Avg Profit: $1,000

Avg Loss: -$500

Profit-to-Loss Ratio == $1,000 / $500 = 2:1

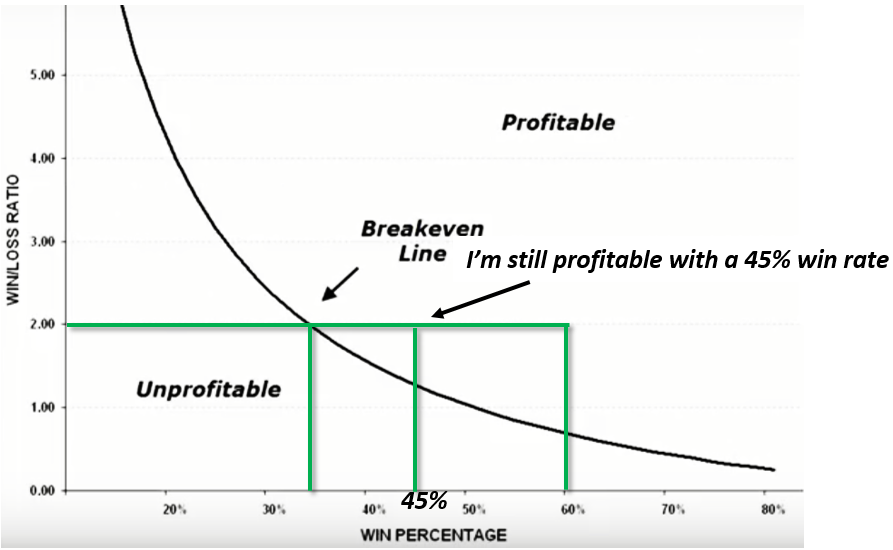

Breakeven Chart

- With a Profit-to-Loss Ratio of 2:1

- Break-even: Even if you are correct only 35% (win-rate) of the time, you can still break even. i.e You can be wrong 65% of the time and still be break-even.

- Profit: Even if you are correct only 45% (win-rate) of the time, you can be making money. i.e You can be wrong 55% of the time and still be profitable.